Micromuni Refund

- Micromuni Refund

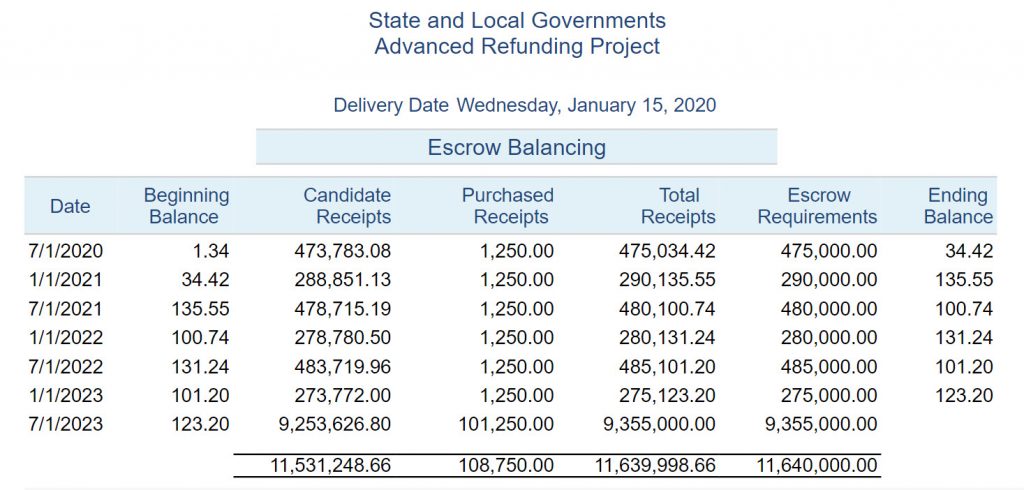

- Escrow Cash Balancing

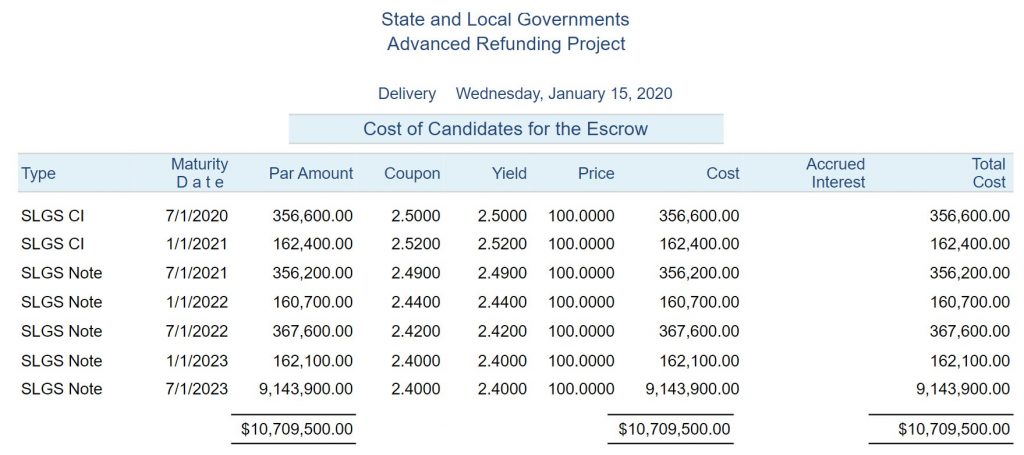

- Cost of Candidate Securities

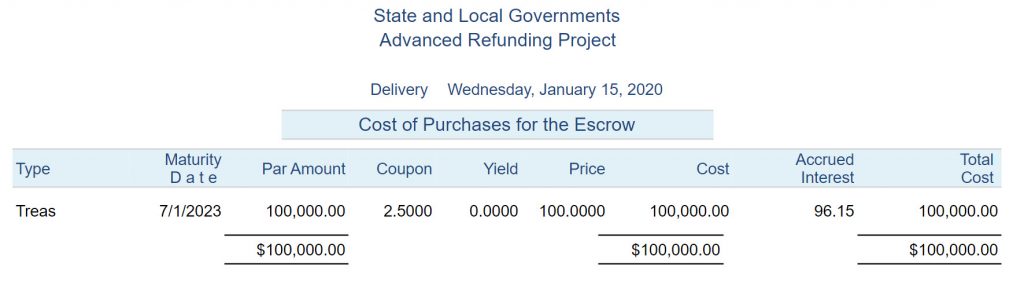

- Cost of Purchased Securities

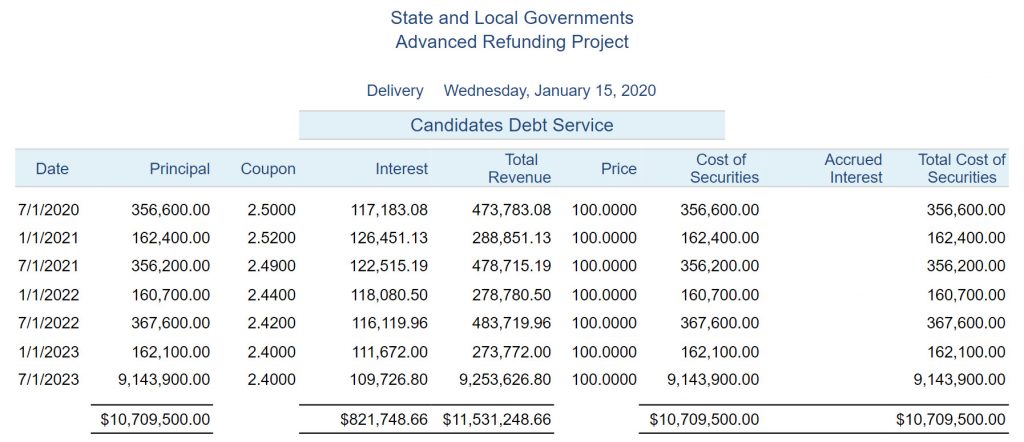

- Candidates Debt Service

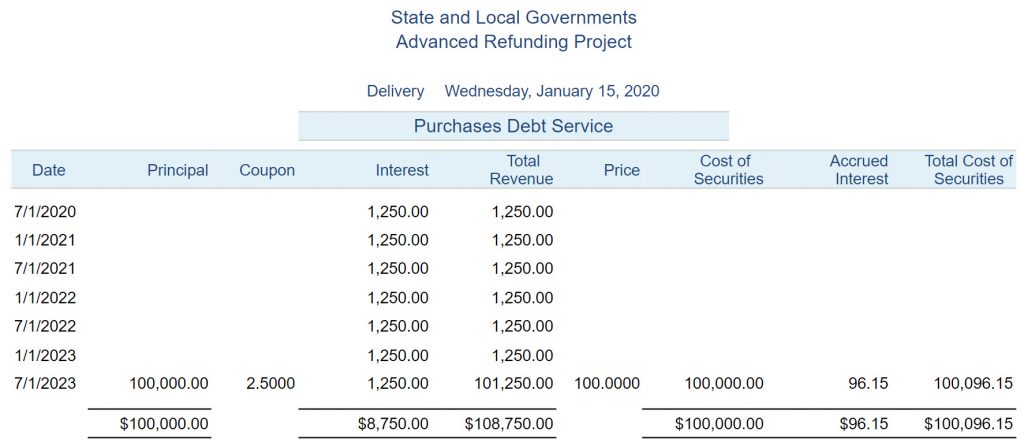

- Purchases Debt Service

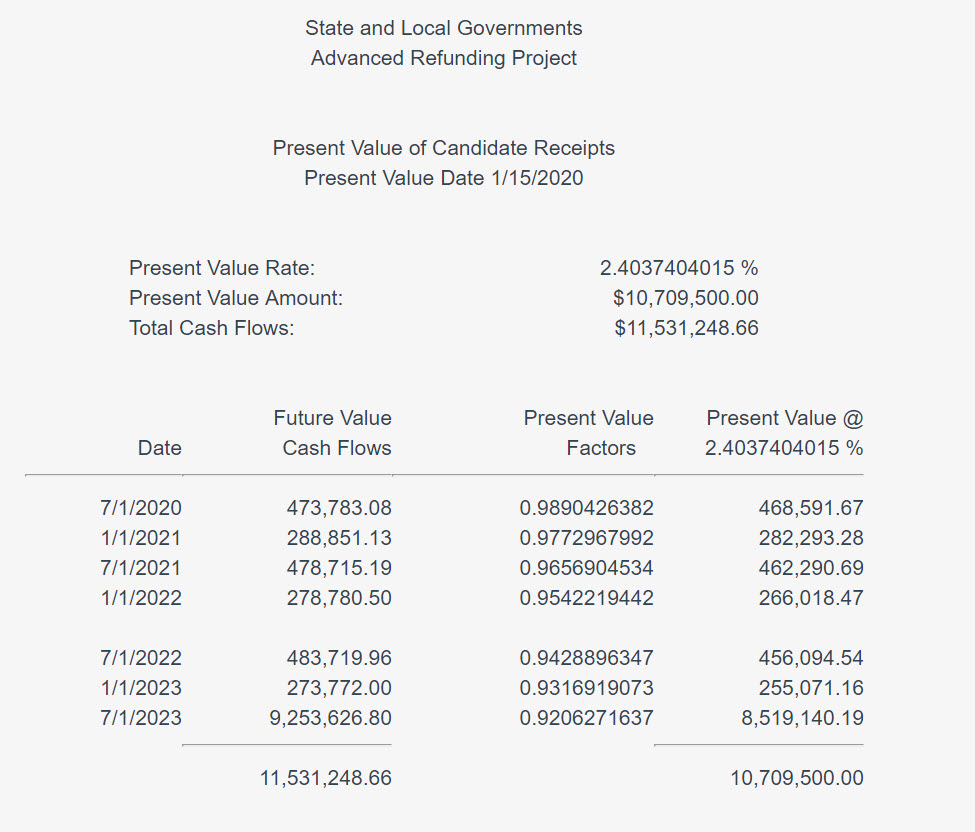

- Escrow Yield Verification

Micromuni Refund is a highly flexible software tool designed to assist bond underwriters and financial consultants in determining a portfolio of securities that will generate sufficient revenues to defease a set of escrow cash requirements. It is particularly valuable in determining the securities necessary for advanced refundings of municipal bond

issues.

Through Micromuni REFUND, you establish a set of escrow cash requirements that can consist of any valid dates and amounts, and you can structure or verify a portfolio of securities for the escrow. The total portfolio can even be a mix of securities with different day/year bases, such as Actual/Actual, 30/360, and Actual/360.

You use input screens to enter or modify information about the escrow cash requirements and the securities. Then you can save the information in data files you can modify or use again. The total portfolio consists of two types of securities: purchases and candidates.

· Purchases are the securities that will definitely be purchased for the escrow.

· Candidates are the set of securities you are considering buying for the escrow. You can have MICRO-MUNI REFUND determine the amount of each candidate that will be required, in addition to the purchases already determined, to satisfy the escrow requirements.

Since candidates and purchases are calculated separately, Micromuni REFUND can even determine the yield on escrow candidates and/or purchases that is essential for advanced refundings and restricted yielding escrows.

With Micromuni Refund, you can:

· Specify up to 512 escrow cash requirement dates and amounts.

· Specify irregular cash requirement dates This is helpful when defeasing several outstanding bond issues or when defeasing a construction draw schedule.

· Define securities used to defease cash flow requirements as either escrow candidates (securities being considered for purchase) or purchases (securities that will definitely be included in the portfolio).