Micromuni Sizing

Micromuni Sizing is a part of our web-based suite of municipal finance tools. It’s specifically designed to assist bond underwriters and financial consultants in structuring a bond issue. All or some of the funds can be used to determine the correct bond size. After solving for the bond size and maturity amounts, Micromuni Sizing will display a sources and uses of funds report displaying how the bond proceeds are used.

Key Features

Flexible Structuring

Micromuni Sizing provides flexibility when structuring a bond issue. The Capitalized Interest Fund and the Construction Fund can be Net or Gross Funded.

Verification of Calculations

Micromuni Sizing can also be used to verify calculations of project financings. Bond Sizes can be fixed by which Micromuni Sizing can back into the Net Amount of funds available for the project.

Comprehensive Reporting

Micromuni Sizing generates detailed reports that provide a clear and concise overview of your financial situation, enabling you to make informed decisions. Some of the reports include:

-

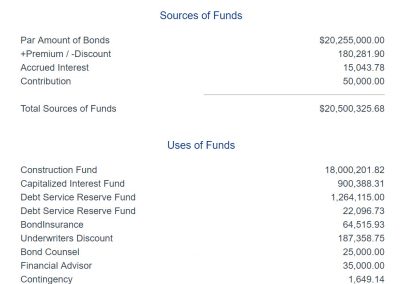

Sources of Funds Report: This report provides a detailed breakdown of the par amount, premium/discount, accrued interest, and contribution.

-

Uses of Funds Report: This report provides information about the allocation of funds to different areas such as the Capitalized Interest Fund, Construction Fund, Bond Insurer, Debt Service Reserve Fund, Underwriters Discount, Bond Counsel, Financial Advisor, and Contingency.

-

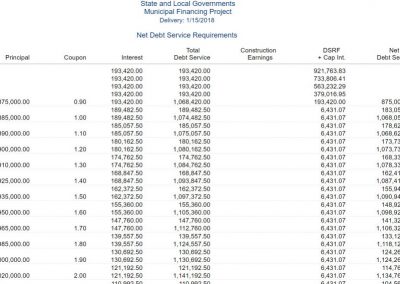

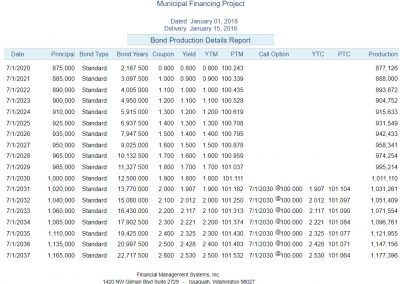

Debt Service Schedule: This report provides a detailed schedule of the principal, bond type, coupon, interest, debt service, fiscal total, and bond balance.

-

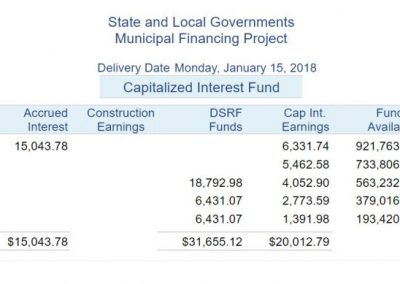

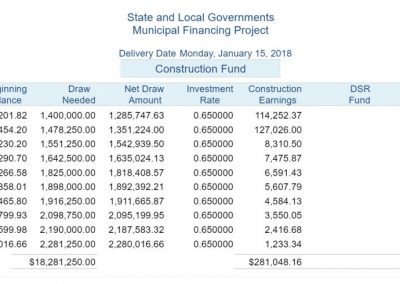

Construction Fund: This report provides a detailed breakdown of the draw date, beginning balance, draw needed, net draw amount, investment rate, construction earnings, DSR fund, cap.int. earnings, and ending balance.