Micromuni Refund

At Micromuni, we understand the complexities of municipal finance. That’s why we’ve designed Micromuni Refund, a highly flexible software tool that simplifies the process of advanced refunding of municipal bonds.

What is Refund?

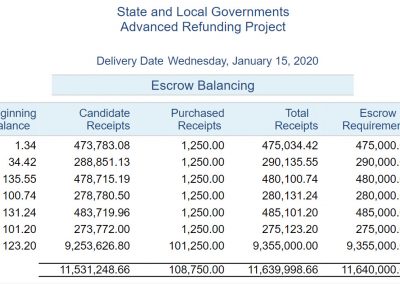

Micromuni Refund is a part of our web-based suite of municipal finance tools. It’s specifically designed to assist bond underwriters and financial consultants in determining a portfolio of securities that will generate sufficient revenues to defease a set of escrow cash requirements.

Key Features

Flexible Escrow Cash Requirements

Establish a set of escrow cash requirements that can consist of any valid dates and amounts.

Portfolio Structuring

Structure or verify a portfolio of securities for the escrow. The total portfolio can even be a mix of securities with different day/year bases, such as Actual/Actual, 30/360, and Actual/360.

Purchases and Candidates

The total portfolio consists of two types of securities: purchases and candidates. Purchases are the securities that will definitely be purchased for the escrow. Candidates are the set of securities you are considering buying for the escrow.

Yield Determination

Micromuni Refund can determine the yield on escrow candidates and/or purchases that is essential for advanced refundings and restricted yielding escrows.

Data Storage

Micromuni processes and stores your data in the cloud so you don’t have to worry about computer crashes, hardware compatibility, or operating system changes.

Advanced Reporting for Informed Decisions

One of the standout features of Micromuni Refund is its comprehensive reporting capabilities. Our software generates detailed reports that provide a clear and concise overview of your financial situation, enabling you to make informed decisions. Here’s a look at the types of reports you can generate with Micromuni Refund:

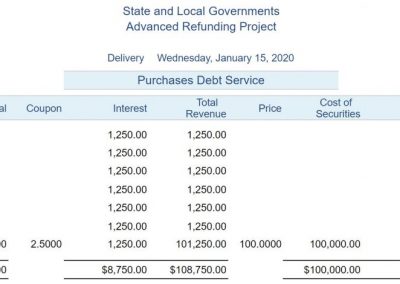

- Debt Service Report: Stay on top of your financial obligations with our Debt Service Report. This report provides a detailed breakdown of the principal, coupon, interest, total revenue, cost of securities, and total cost of securities for each date. It’s an invaluable tool for tracking the debt service of the securities in your portfolio.

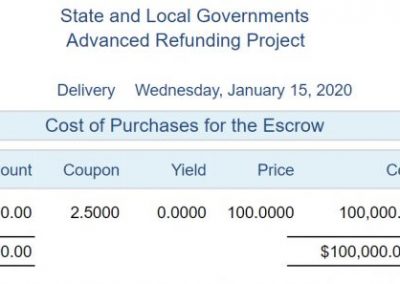

- Cost of Purchases for the Escrow Report: Get a clear picture of your escrow purchases with this report. It provides information about the type, maturity date, par amount, coupon, yield, cost, price, accrued interest, and total cost of the securities that will definitely be purchased for the escrow. This report is essential for understanding the cost implications of your escrow purchases.

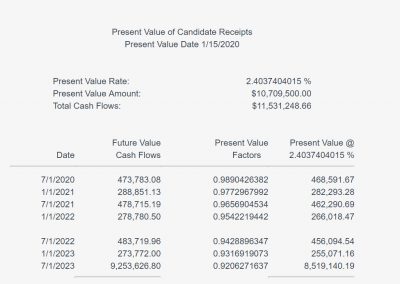

- Present Value Calculations Report: Evaluate the potential return of your securities with our Present Value Calculations Report. This report calculates the present value of candidate receipts, including the present value rate, present value amount, total cash flows, future value, present value, and present value at a specific rate. It’s a powerful tool for assessing the profitability of your securities.

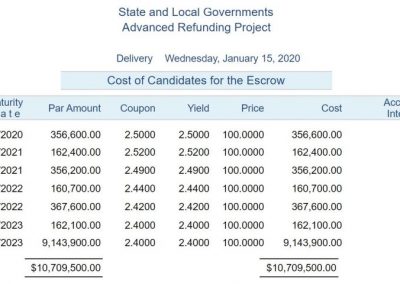

- Cost of Candidates for the Escrow Report: Understand the financial implications of your potential purchases with this report. Similar to the Cost of Purchases for the Escrow Report, it provides information about the securities being considered for purchase, including the date, principal, coupon, interest, total revenue, cost of securities, price, accrued interest, and total cost of securities.

With Micromuni Refund, you’re not just getting a software tool – you’re gaining a partner that provides you with the insights you need to make informed decisions. Start using Micromuni Refund today and experience the difference.

View Refunds Reports